75000 or less for singles 112500 or less for heads of household. The current child tax credit has been distributed in monthly payments of either 250 or 300 for each eligible dependent child depending on age and income.

Parents Guide To The Child Tax Credit Nextadvisor With Time

From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17.

. To put the cost into perspective 61 million families received child tax credit payments last monthThe total cost of those payments was 15 billion. Under the Biden-Harris Administration the 2021 Child Tax Credit will increase to 3000 for children ages 6 12 and 3600 for children 6 and under. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

To be eligible for the maximum credit taxpayers had to have an AGI of. Democrats in Congress last March approved an expansion of the Child Tax Credit that ran from July through the end of 2021. Theres a slim chance that the bill will pass without Manchins support.

The couple would then receive the 3300. The other half of the credit can be claimed as a lump sum on taxes in April. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of.

According to the center as of December 2021 the Internal Revenue Service IRS has paid out six months of advanced child tax credit payments worth up to 250 per child between the ages of 6 to 17. The number of children living in poverty decreased by 40 when the monthly child tax credit payments were sent out from July to December 2021. 2021 Child Tax Credit July-December advanced payments May 06 2021 Nick French The standard 2000 child tax credit is about to see a major overhaul in 2021.

It also provided monthly payments from July of 2021 to December of 2021. If you and your family meet the income eligibility requirements and you received each payment between July and December last year you can expect to receive up to. Since July the Treasury Department has sent out around 77 billion to qualifying parents across the nation.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest monthly child poverty rate since December 2020. Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17 years old.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. 10 million children will fall back into poverty when the enhanced child tax credit ends.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between the ages of 6 and 17. If you and your family are eligible and received each payment between July and December of this year you can expect to receive up to 1800 for each child age 5 or younger or up to 1500 for.

The entire benefit amount will amount to 3600 per eligible child maximum with half of the benefit 1800 deposited in the six monthly payments. Up to 1800 per child will be able to be claimed as a lump sum on taxes in 2022. Here are more details on the December payments.

By the end of the 2021 eligible families will have received payments of up to 1800 per child. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. The final half of the enhanced tax credit will come.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. We dont make judgments or prescribe specific policies. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27 2022. Ad Everything is included Premium features IRS e-file 1099-MISC and more.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the. Most eligible families received payments dated July 15 August 13 September 15 October 15 November 15 and December 15. The program extended payments of 250-per-month for children ages 6.

Learn More At AARP. So each month through December parents of a younger child are. Those payments will last through December.

Washington DC-area residents Cara Baldari. See what makes us different. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000.

The sixth Child Tax Credit payment kept 37 million children from poverty in December. The 2021 increased child tax credit was part of Bidens 19 trillion American Rescue Plan that went into law in March 2021. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Pin On Foster Adoptive Info Blogs

A Major Change Might Make Your Next 1 200 Stimulus Check Much Bigger Travel The World Quotes Notary Notary Signing Agent

Child Tax Credit 2021 8 Things You Need To Know District Capital

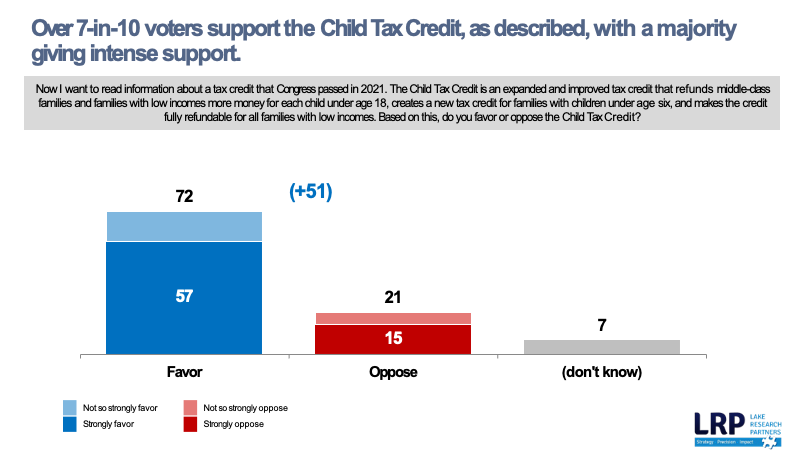

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The Family Security Act 2 0 Creates Winners And Losers First Focus On Children

Organize Small Business Taxes Plus Free Printables

4 Commonly Overlooked Tax Deductions Not To Miss Tax Deductions Tax Refund Tax Time

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities